What Happened Friday? And How to Make Volatility Your Friend

Even If That Volatility is Donald Trump. A reflection on the week, the year, and all of human history. Ok it's not THAT long of a post. Check it out!

Making friends with volatility? The biggest enemy of mankind?

That sounds grandiose.

But hey, why not?

Well, I had a crappy day Friday.

Only got six hours of sleep

My workout was hard, maybe because I didn’t have caffeine or creatine in the morning

It was also the kind of very frustrating for men workout where you’re doing things that don’t look hard with very little weight and it’s still really freaking hard

I had my first negative trading week since August 20th. That’s a good record and I’m pretty sure it’s temporary, but I HATE LOSING.

My wife said, you have to know losing is going to happen.

I said, “Yeah, but you can still hate it. I bet Michael Jordan every single loss he ever had.” Pretty sure that’s well documented.

I have unrealistic standards, and I like them.

And she’s well meaning, but when you’re aggrieved and up in a lather, even a hot bath won’t clear it out.

Maybe an emotional substack article will.

BE THEE DISCLAIMED: This is not financial advice, just the ramblings of a crazy trader who enjoys being mad at and grappling with markets. Consult a real professional before making investment decisions. And a psychiatrist, pastor, rabbi, or life coach if this post disturbs you.

BTW, I often use the word “you” to mean “one”, and talk about myself with the royal “we” because WE spend too much time alone. Fun, right? (I think so.)

Hello Volatility, My Old Friend

(Doesn’t quite roll off the tongue the way Paul’s did. Demasiado syllables.)

I didn’t look at my IRA, really EVER, until January this year when I decided to make trading a hobby.

Why not? I didn’t care, didn’t know how to look at it, and maybe was afraid to look. But I finally did.

I had no idea what a historically crazy year I was going to start trading in. Some of the hardest trading in a long time. Well ok not as hard as 2022 or 2007 or 2020 or 1973. But definitely harder than 2023-24 when everybody should have been making money- easy.

I was lucky I had everything in growth stocks then. Those were great years for growth.

This year is too, but in a much more complex way.

Tech and AI have gone nuts, as you’ve heard, but so did gold and gold miners.

Why’d they go loco?

Instead of being uncorrelated or decorrelated - a complex topic we’ll cover more later - gold and the Nasdaq became quite correlated.

Ok but why?

Because investors wanted to have their cake and eat it too. The same people and institutions that were in the indexes also moved heavily into gold.

Instead of using the weak so-called traditional “hedges” (money markets, high yield savings accounts, bonds, munis, or inflation protected treasuries (TIPS)), they wanted to hedge by finding more big gainers like tech/AI, but with some degree of correlation hedge.

“So yeah, I’m hedging… but I’m also making money with my hedges!”

- Some dufus like me, probably, talking on a cellphone in L.A. while looking for a burrito

And yeah, when the gold miners took off, I rode them like wild stallion pegasususes into the sky.

(Pegasi sounds weird and probably is illegal.)

When Howmet aviation TOOK OFF, I boarded their plane. And I also got off before they dipped and flew sideways for months.

Same with Rolls Royce (you know, the Kriegsmaschine): we rode in style for a while, then the valkyries got lost while guiding Howmet to heaven.

(Relax, I had to ask AI what the German was for “war machine”. I think it’s also a Sabbath song? Nope, AC/DC.)

And blah blah blah more rocketing stocks all the way up to crypto now with STCE and WGMI, which are very nice ETFs if you’re into that kind of thing…

So what?

Well, it’s a complex, fast-paced game to average 4-8% returns in a month. Kind of exhausting, actually.

And what I’m learning more and more is that this totally lame sounding advice is true:

“Manage your risk and the returns follow.”

- Howard Marks, probably quoting Benjamin Graham,

but not as wordily as BGraham did- but imagine if BGraham had Twitter!

He’d def rock some econ tweets.

What The Heck Is Volatility?

It’s someone crashing into your car, which literally and figuratively slow you down. Repairs cost money and time.

It’s the unpredictability of crime in poor neighborhoods, keeping poor people poor.

It’s also what creates really cool indie rock bands, but they tend to flame out, unfortunately.

“PAVEMENT FOREVER! HECKLER SPRAY!”

- Me, right about when I almost cut my hair

The more predictable things are, the more things grow. A boring home can raise healthy kids. Bob Ross is reassuring. A VTI portfolio, even ignored for 20 years, can produce great returns.

Boring can be good.

But what about…

Trade Wars: Will These Ones Really Matter in 100 years?

What if someone messes with the market? Intentionally or not?

What if someone is fighting a trade war or struggling with a lifetime of deep insecurity? Perhaps at the same time.

Well, you can just follow the current!

(No, I’m not saying you give in politically or morally. Stay tuned.)

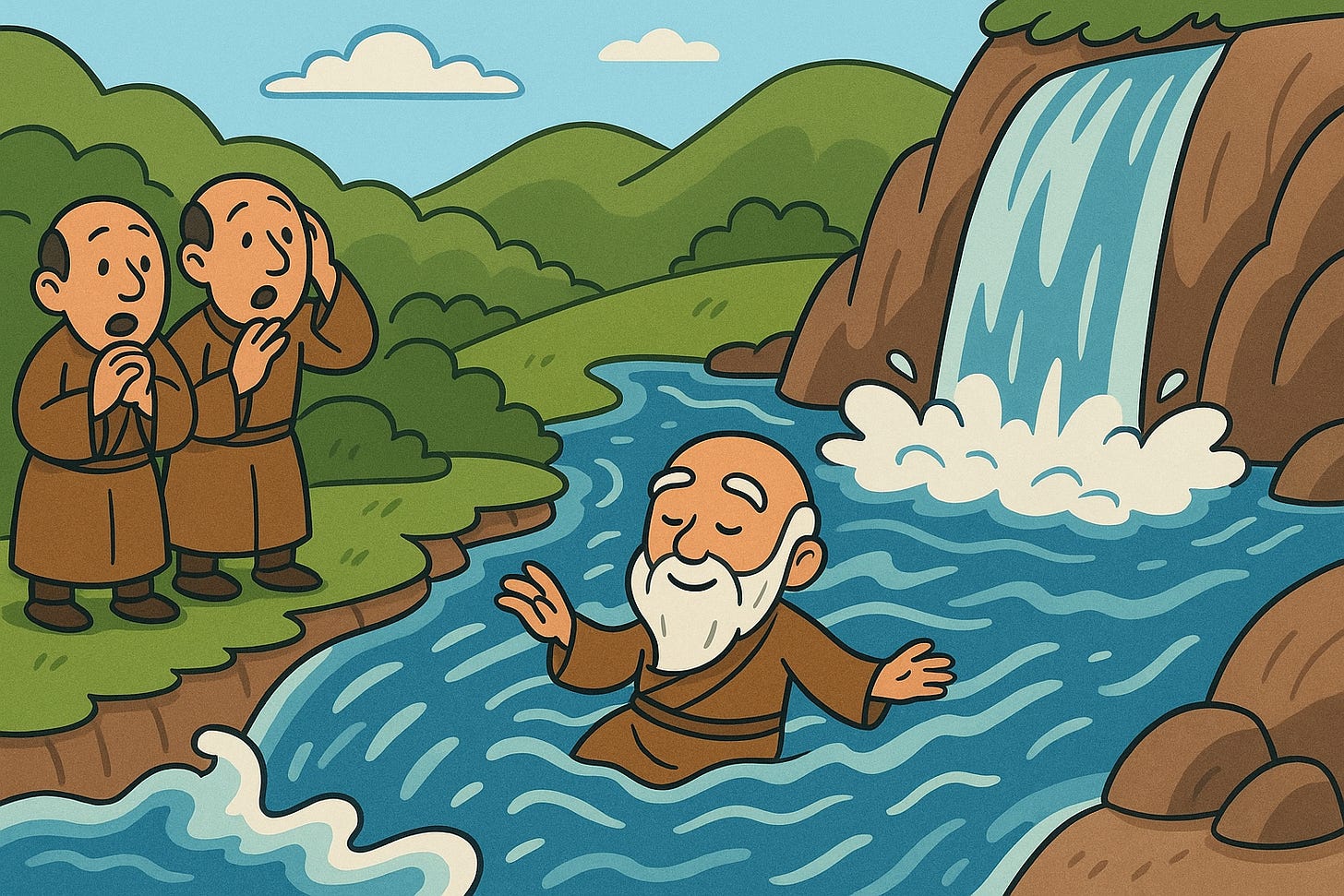

My favorite Zen story is:

A group of onlookers witness an old master accidentally fall into dangerous river rapids leading toward a waterfall. Expecting his demise, they rush downstream, only to find that he emerges safely and calmly. When asked how he survived, the master explains that he didn’t fight the water or attempt to resist its force; instead, he let himself go with the current, allowing the water to carry him naturally, and thus avoided harm.

How can you not love a monk who bodysurfs!

I’m not telling you not to resist autocrats and bullies in every form- that’s a whole NOTHER topic.

What I’m saying is: find trends and take advantage of them.

Even If It Is About Trump, What Can ONE Do Financially?

This article isn’t about Trump, but his actions and their impact do make ya think, don’t they.

When one comment on social media drop the market by 2%, how can you avoid that kind of investing volatility?

Sure, SPY and QQQ and VTI have been good for a long time. And in my opinion, they are capitalism, just just US but international, since 30-40% of S&P500 company revenues are from outside the US.

Capitalism ain’t going nowhere.

Even if it is coopted by socialist government-invested corporations.

(Wait- am I talking about China or the U.S.? It’s hard to tell right now.)

What’s the trend? What caused this?

If we look back at what brought us here, it’s the monetary policy instituted after that big old mortgage FRAUD thing Margot Robie told you about. We borrowed against our future and, as with all debt, sooner or later, the collector is going to call.

We can try to push it off like unrealistic brats, swirl down the drain into stagflation, and then next president can get blamed for it just like my namesake was.

I still remember yuppie larvae in kindergarten teasing me that I was probably voting for Carter cuz it was my name, too. Instead of wondering why 6 year olds knew anything about presidential elections, or why we were mock voting in them, I just pretended I knew what was going on. And evidently never got over it!

But it’s not even Trump’s fault, really. It’s globalization, which is an undeniable tsunami. No matter how much Detroit and other former factory towns want that to change, there’s no painless fix. There aren’t enough fingers for the dyke. The windmill won’t tilt. The metaphors won’t metaphor.

Related note:

Isn’t it ironic that crypto is supposed to create stability and save us from things like government overreach, but a president can crash our finances with one comment?

Is it that fighting globalization is bad for everybody?

Nahhhhhh.

Why is all this really happening?

All of this: growth, greed, change, new tech, new ideas, new places…

At the root, it comes from the restless human heart. We have to move, grow, adapt. That’s what has kept us alive for all of human history.

Human nature isn’t changing.

Change isn’t changing.

You can’t fix that.

Truth: There Will Always Be Volatility, But There Are Ways to Manage It

How? Know the trends, especially big macro ones like:

Our populations are shrinking. Only India and China aren’t. Western countries are winding down and transforming. Who’s going to be working and paying into social security if there are fewer young people?

AI may be the only thing that might save us from the decline that results from not enough young people to sustain older people’s retirement.

Theres both political and economic movement from the center to the extremes. Many are being pushed out of the middle to ascend upward or spiral downward. The U.S. system works worse and worse for those in teh middle.

Americans aren’t like Europeans. They don’t care to live better if it means making less money or not being number one.

China and India are hungry. They want to be the next people to give birth to spoiled brats who can spend a ton of money recklessly and borrow against nothing. They probably will be those people.

Does it sting that the U.S. empire may only last 300-400 yea? That’s how long the British empire survived. The Romans made it 500, but listen- they didn’t have to contend with social media and affordable global travel or a profitable colony full of criminals and zealots.

The US is still in control of a lot, if this year proves anything. Somebody shifted their quite significant weight around, and everyone felt it.

But it also has woken people up.

Just as during and after the pandemic, people and systems and corporations have had to respond, adapt, face new risks, and grow stronger.

So what to do?

I’ve Got the MO!

Momentum, those economic and social currents we can bodysurf, is one answer.

I’m a momentum trader. And a big believer in momentum in life and business. Get it, keep it, take advantage of it.

Homeless people have trouble doing that, right? Can’t get a job, cleaned up, references, all that. Somebody punches you in the nose at the shelter and you look horrible at the interview. No job.

Sometimes you lose all momentum and you’re stuck.

First, don’t let that happen. Second, don’t take your momentum for granted and ease up. By all means, enjoy your life, but don’t take your foot entirely off the gas. You’ll regret it. Or just wonder what happened.

The opposite of momentum?

Value investing: the investment philosophy that served Buffet and Munger so well, but as research documents, has been less effective the last 10-20 years because… everyone has virtually the same knowledge, and AI is accelerating that.

There’s a risk to manage in buying undervalued stocks- maybe it’s not undervalued and you grabbed a falling knife!

There’s a risk to jumping from one cresting momentum stock and trend to another- you can’t stop or down you go.

Even during momentum trading- what goes up is likely to come down. But maybe only a bit! You can manage and measure that risk.

And sometimes it doesn’t crash at all- it just keeps gathering momentum. Good for you.

Nerdy Asset Volatility Metrics

To get a little technical for a minute, here are some types of asset volatility I’ve been tracking and managing, because there are more than just a few angles:

Sharpe ratio or risk-adjusted returns (RAR) are the best known; standard deviations are your friend.

Sortino ratio emphasizes the drawdowns, because SHOCKER- the stocks that go up the most are also the most volatile, because VOLATILITY DOESN’T HAVE ONE DIRECTION. But if it goes up more than it goes down, then it’s worth the ride. You can compare a stock’s average return over a time period to its biggest drawdown (loss), and that’s another great metric.

You want to find stable gainers, right? The ones that go up consistently with the least volatility? Price linearity. Correlation of the stock’s price to a straight line is another friend.

Multiple timeframes- we don’t want things that are only good recently- we want to avoid investing in things that are fads- so looking at the RAR, avg return vs max DD, and linearity over multiple time periods is a good idea, too.

Correlation risk is really screaming at me lately- if crypto is highly correlated to tech (and it is), then when the Nasdaq goes down, so does crypto, LIKE TODAY. It’s not at all a hedge against the risks of an AI bubble popping.

“Why Don’t You Just Go Get… Decorrelated!”

The cool thing is that there are stocks and ETFs that are less correlated to a lot of things, and when you find those that have good, consistent RAR, you’ve really got a nice net below you when major markets, or AI, or crypto falls.

That’s right: in between the false opposites of momentum trading and value investing, we have a balanced alternative: RISK-MANAGED MOMENTUM INVESTING

You can even include fundamentals that presage stability, like: earnings per share, trading volume, institutional ownership, and free cashflow yields.

What’s the upshot, Brian in a really cute little conclusion format?

Listen, Alfie.

We can’t understand everything in life, and we can’t control everything, but in the end, if you get to know volatility and risk in all its forms, and you manage them, good things follow.

(Or at least, much better than the ones that car-crash and nose-punch into you out of nowhere.)

That’s my piece for today. And yes, I feel much better. Thank you!

This was funny somehow! - > China and India are hungry. They want to be the next people to give birth to spoiled brats who can spend a ton of money recklessly and borrow against nothing. They probably will be those people.